The third “Belt and Road Initiative” (BRI) forum, held in Beijing last October, marked the 10th anniversary of president Xi Jinping’s flagship initiative. More than 150 countries – worth almost 50% of global GDP – have joined the scheme of this massive $1000bln project, which is building roads, railways and other infrastructure worldwide. China claims the BRI has created 420,000 jobs and lifted 40million people out of poverty. At the same time, most of these infrastructures was financed by the Chinese government, which became the largest creditor in the developing world, strengthening its diplomatic and geopolitical clout. “Many in the West think its true aim is to build a Chinese-led World order in which unsavoury regimes can thrive – wrote The Economist for the 10th anniversary – the guest list at this week’s summit resembles a gallery of rogues. Vladimir Putin will have a leading role. Even the Taliban send a delegation. Does China’s BRI bankroll international development or cement autocracy?” Certainly the BRI is becoming increasingly controversial and unpopular. In 2013 Xi claimed the Initiative would establish a “stable and sustainable financial safeguard system that keeps risks under control”. Instead, the opposite has happened: BRI is bringing many host countries to the brink of bankruptcy.

Ethiopia is the main African case. In recent years, BRI projects have struggled to meet the expected results, causing Ethiopia’s public debit to grow to $30bln – more than half of Ethiopia’s GDP – at an annual cost of $2bln, almost 50 per cent of the country’s export revenue. The Ethiopian economy is going through a serious crisis: foreign currency reserves are about to collapse and cannot even cope with one month imports, while inflation runs above 50 per cent. On the black market the Ethiopian currency has reached a trade off value of almost 100 to 1 against $, compared to the official exchange rate of 53. The country is on track to default, having stated that it could not pay a $33mln coupon on its $1bln Eurobond due on last December. Already at present the majority of the population can barely get through.

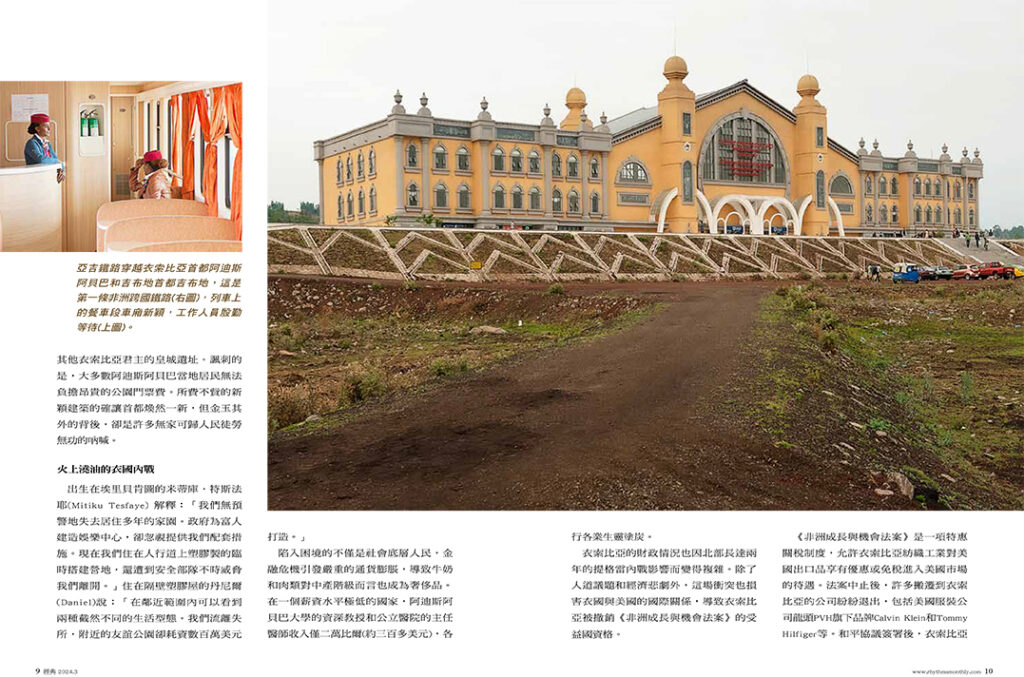

BRI’s national jewel is the new Addis-Gibuti train that connects the Ethiopian capital to Gibuti’s Doraleh port, where China has placed its first mainland military base and set up a multifunctional seaport, including a huge container area and an oil terminal – through Bab-el-Mandeb strait, the so-called “gate of tears”, passes almost half of China’s oil import and more than 40 per cent of the whole sea traffic. The new railroad, built by China Railway Engineering Corporation (CREC) and financed by Export-Import Bank of China (ExIm) with $4bln, follows the old one installed by French colonizers between XIX and XX century. Walls and speakers in stations and trains speak Chinese – Amharic, the national language, appears only in the subtitles – since the new railway was above all conceived for the many Chinese businessmen who relocated production to Ethiopia in search of lower wages.

But the list of the new Chino-Ethiopian infrastructures is very long and extremely relevant to Xi’s project on East Africa. An example is the expansion of the Bole international airport: $345mln financed by ExIm and carried out by China Communications Construction Company (CCCC), which made it possible to double the capacity of the main Africa’s air traffic hub, reaching over 25mln passengers per year. Also Chinese are the $3bln that finance the engineering power-grid transmission to connect the hydropower plants GibeIII on the Omo river and Grand Renaissance Dam, the largest African hydropower plant built on the Blue Nile. Chinese companies are expanding mobile and internet coverage in rural areas ($2.5bln) and building several new industrial parks with the aim of turning Ethiopia into a global hub for the textile and manufacturing sector. Many Chinese companies, such as JP textile and Shanghai textile, have set up in industrial parks owned by the Ethiopian government. Others, such as Sheng pharmaceuticals and Huajian shoe manufacturer – which employed more than 7,000 workers in Ethiopia at its peak in 2018 – built their own private industrial zones. All the above infrastructures were directly entrusted to Chinese firms without any tender and in strict confidentiality as concerns financing terms. Key conditions for Beijing’s granting of loans.

Despite interest rates almost double those applied by the World Bank (averagely 4% compared to 2%), the key of success for Chinese financing is the immediate availability of the funds, in the speed of fulfilment and in an almost non-existent bureaucracy. A dangerous cocktail that brought Ethiopia on the brink of financial collapse. In December, Fitch downgraded the country’s credit rating for the third time this year, from CCC to C, indicating Ethiopia “increased likelihood” of default. Moody made the same last September. JPMorgan has rated the risk of imminent default as “maximum”. “Unless the debt payment is reshuffled, Ethiopia will default”, explains Alemayehu Geda, professor of Economics at Addis Ababa University, “First solicited at the G20 in early 2021, restructuring of the Ethiopian debt has been constantly postponed and no agreement among Common Framework creditors has been reached yet. Western countries demanded that every detail of China’s loan agreements with Ethiopia be exposed to all creditors. A condition Xi doesn’t accept, faithful to its bilateral negotiations policy”.

The majority of Ethiopian public debt is held by the Chinese government. Beyond a third of the official debt, China is the creditor of at least another “hidden debt” of $5bln, contracted by State owned companies and banks or other joint ventures not included in the State financial statement despite benefiting from public financial coverage. Shedding light on the rise of “hidden debt” during the BRI era is “Banking on the Belt and Road”, a report by AidData. “Since BRI was launched in 2013, the Chinese government has been trying to use debt to gain a dominant position on the financial market – explains Bradley Parks, executive director of the US based research centre – Globally almost 70% of China’s overseas lending doesn’t appear in the World Bank official statistics because they are not recorded in the central governments balance sheets. These unreported debts are worth approximately $385bln and problem is getting worse over time. As China financed ever larger projects and increased the level of credit risk, Xi imposed on debtors stronger repayment safeguard like collateral conditions”.

As concerns Ethiopia’s debt, China appears to have asked to use “alternative means of payment”. According to The Reporter, one of the most authoritative Ethiopian newspapers, “during a visit to Beijing last February, Ahmed Shide, minister of Finance, agreed with his Chinese counterpart to restructure Ethiopia’s debt through alternative means. These strategies range from exchanging debts through various mechanisms to increasing shipments of raw materials to China and awarding other projects to Chinese investors”. The risk is that BRI mega-projects in Ethiopia could end like the Hambantota harbour in Sri Lanka or the railway connecting the capital city Ventiane to Chinese province of Yunnan in Laos: both infrastructures which China financed and built, but later, due to unsustainable debts, has obtained 70% of the property and exclusive concession for 99 years. In the last 3 years Chinese banks have not provided any loans to Ethiopia, but Xi announced recently that China would grant one year of debt service relief. Furthermore, after the last BRI forum, the Ethiopian government announced “a positive response” from Wu Fulin, chairman of ExIm, to address the withheld disbursement of loans of $1.3bln, which has caused significant delays in Ethiopia’s infrastructure development.

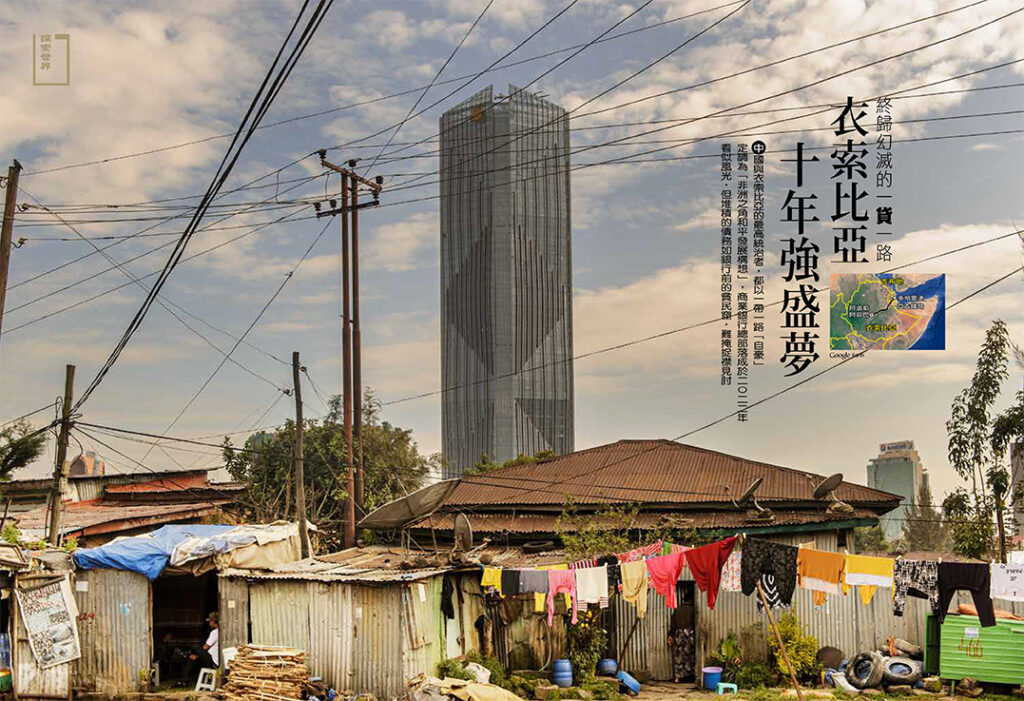

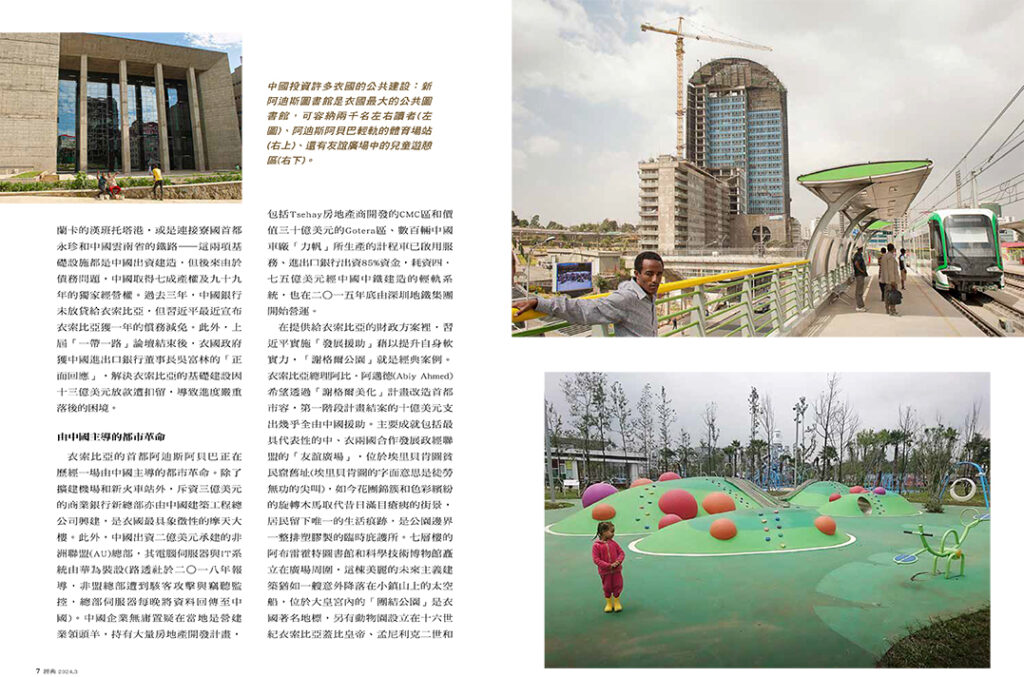

In Addis Ababa, China is driving a urban revolution. In addition to the expansion of the airport and the new railway station, Chinese have built the new headquarter of the Commercial Bank – the tallest skyscraper in Ethiopia, built by China State Construction Engineering Corporation and financed by ExIm ($300mln) – and the African Union (AU) headquarters, fully financed ($200mln) by the Chinese government and its IT system built by Huawei – in 2018, Reuters denounced that the headquarters had being hacked: AU servers were sending data back to China each night and the buildings were bugged with cameras and microphones. Chinese companies are undisputed leader in the construction industry with massive real estate projects, like CMC area developed by Tsehay real estate and the $3bln one on the way in Gotera area. Hundreds of “Li Fan” taxis have been put into service and since late 2015 Shenzhen metro group has operated a $475mln light-railway system (implemented by CREC and 85 per cent financed by ExIm).

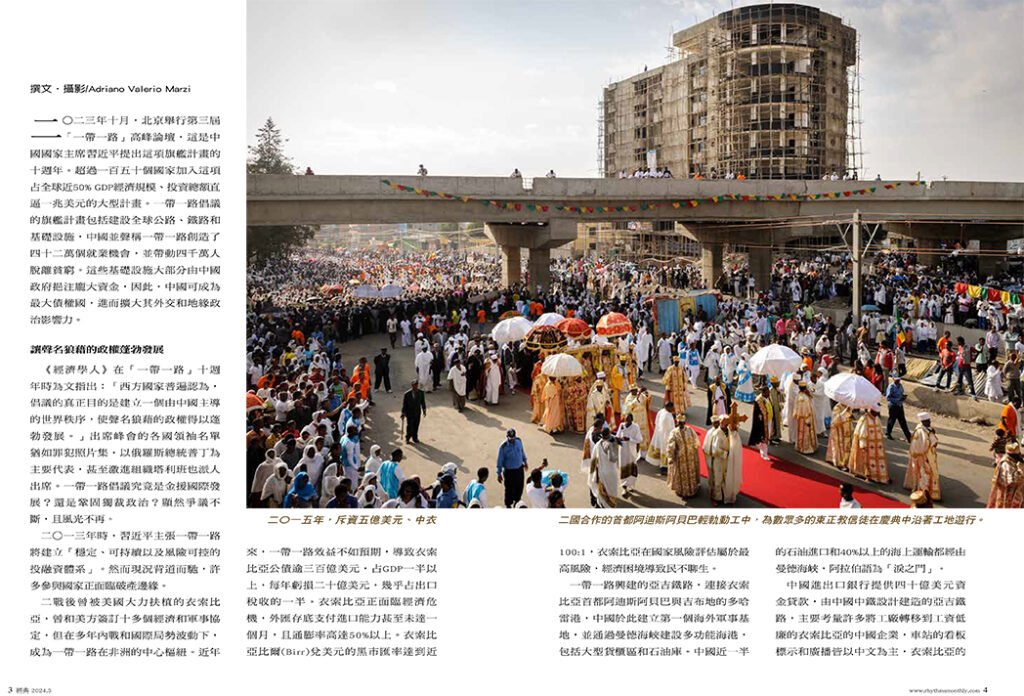

Mindful of the management of his enormous soft power, Xi added some “development aid” to the Ethiopian financial package. This is the case of the “Beautyfing Sheger” project, wanted by Ethiopian premier Abiy Ahmed to change the capital’s look. One billion $ of spending just in the recently concluded first phase, almost entirely financed by China Aid. Among the main achievements is the “Friendship Park”, symbol of the flourishing political-economic alliance between the two countries. The Park was built in the area where once stood the slum Erii Bekentu – literally “if you scream no one hears you”- now buried under flowerbed and colourful merry-go-round. The only trace of the former inhabitant is the long line of plastic shelters located at the border of the Park. On the side of the area stand the beautiful seven floors Abrehot library and the Science and Technology museum, a futuristic building similar to a space ship that landed abruptly on the town’s hills. The new tourist zone is completed by the Unity Park, another zoo-park set up where stood Ghebi, the imperial citadel of Menelik II and all the other Ethiopian sovereigns. Exclusive projects – the ticket price of the park is unaffordable for the majority of Addis inhabitants – which have undoubtedly improved the capital’s appearance but at a high financial and social cost, as it shows the largest number of homeless people.

“We have lost our homes, in which we have lived for years, without any warning or offer of alternative options”, explains Mitiku Tesfaye, born and raised in Erii Bekentu, “The government has built recreational centres for the haves, but it has neglected us. Now we live in plastic makeshift camps on the sidewalks, where the security forces always threaten us to leave the place”. From the plastic house next door, Daniel continues: “You see two types of life within a short distance. We are in destitute conditions while the nearby Friendship park project is a multi-million dollar project”. But it’s not just the miskins, the poorest people, who are in trouble. The financial crisis caused a strong inflation, which made milk and meat luxury items even for the middle-class. In a country where the salary level is extremely low – a senior-professor in the Addis universities or a chief-physician in a public hospital earn around 20,000 birr (few hundreds dollars) – people can hardly make it.

The country’s financial situation has been complicated by 2 years of civil war in the northern Tigrai region. In addition to the tragic humanitarian and economic drama, the conflict has contributed to damaging the relations with the US, causing among other the suspension of Ethiopia from the beneficiaries of the Africa Growth and Opportunity Act (AGOA), the preferential tariff system that has allowed the new Ethiopian textile industrial parks to be competitive on the US market. The suspension from AGOA has caused the exit of the majority of the companies that had relocated to Ethiopia, including the US giant PVH, owner among others of Calvin Klein and Tommy Hilfiger trademarks. After peace agreements the Ethiopian government removed the Tigrinian rebels from the list of “terrorist organizations” and appointed their spokesperson, Getachew Reda, leader of the new ad-interim government in Tigrai. Not enough to get sanctions removed by US. On February Washington has reinstated its ambassador, Tracey Jacobson. But during her recent visit to Hawassa industrial park, Ethiopia’s most important, she explained that “in order to be readmitted to AGOA, the Ethiopian government must allow international human rights experts to enter conflict-affected areas of northern Ethiopia”. A call supported by more than 60 organisations including Amnesty International and Human Rights Watch. However it is still opposed by Abiy, 2019 Nobel prize for Peace.

If industrial parks do not restart soon, avoiding bankruptcy seems like an impossible mission. This possibility does not only scare Ethiopians. Today dozens of countries involved in BRI are at risk of default, having levels of debt exposure to China exceeding 10 per cent of their GDP. Ethiopia’s default could trigger a domino effect, which could involve the entire Chinese global development model. To avoid this scenario Chinese banks would be involved in a strong bailout program: according to a study conducted by researchers at AidData, World Bank, Harvard Kennedy School, and Kiel Institute for the World Economy, China spent $240bln to bail out countries struggling due to BRI debts between 2008 and 2021. “Emergency rescue loans are a very risky business”, explain the report’s authors, “It could succeed if your borrower faces a short-term liquidity problem. But it could devastating in the case of long-term solvency problem”